Record Setting Investment

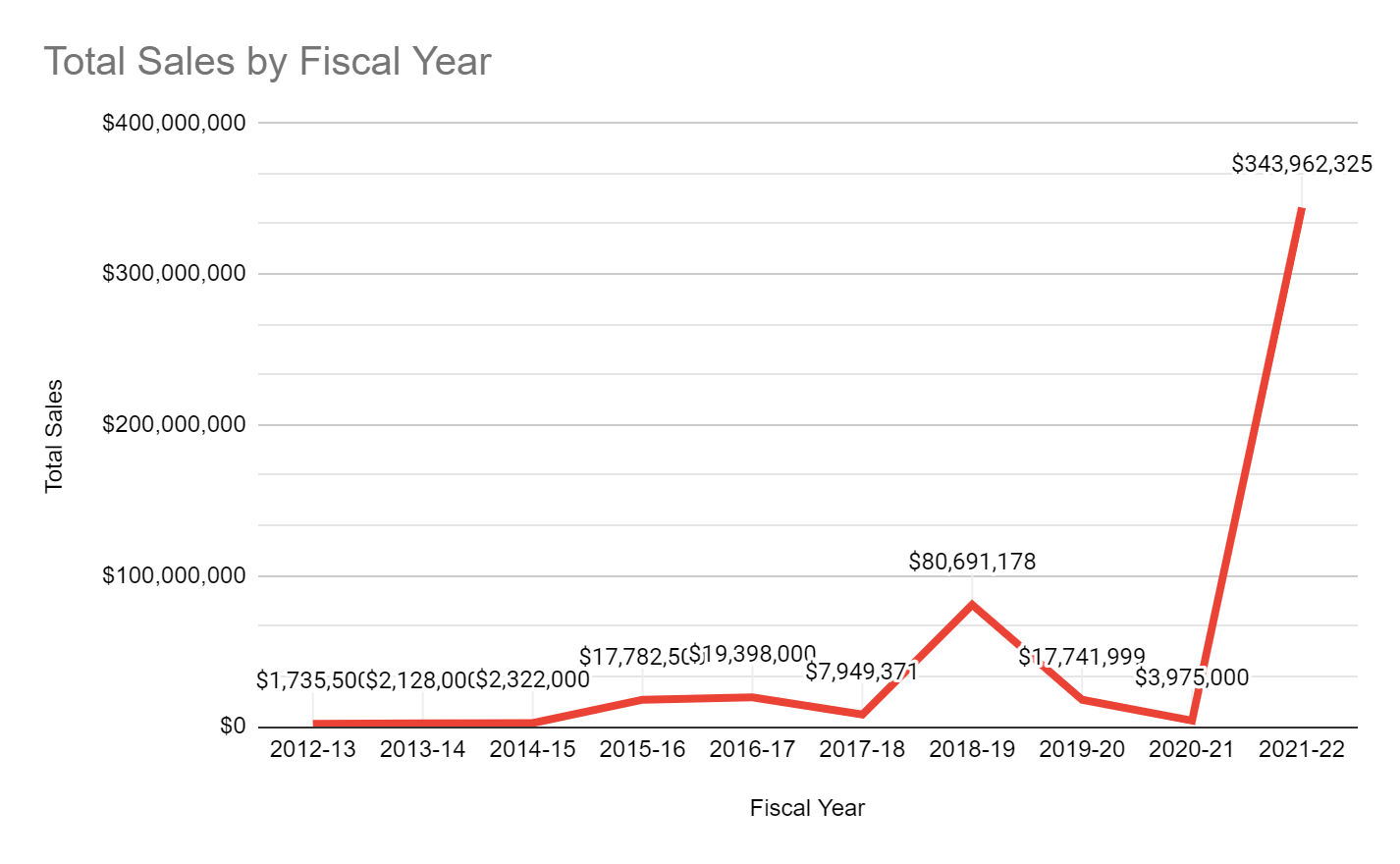

Quarantine and 2019-2020 have been a time of near stasis and recalibration for patron and employee needs by vendors within the corridor. The 2020-21 year cycle has had the lowest total sales since 2014-15. But, with the new year, the ease in the pandemic protocol, the rise in the percentage of the population vaccinated, and expected projections for improvement in the economy, investors have been capitalizing on the opportunity that lower prices and a prime location give them. Property sales for the first half of 2021-2022 are 85.5 times the investment in the prior year; this is the largest spike on record!

The largest transactions, numerically and quantitatively, have been in the real estate market. Just to highlight a few, Stanhope Apartments gained new ownership in a deal for over $131 Million, while DoubleTree switched hands for around $40 Million. The Edition on Oberlin was acquired by Preiss Company for $71 Million from Leon Capital Group. Another transfer to note is that of six properties from FMW Real Estate to Horizon Realty Advisors for a total of $56.5 Million. These massive investments are taking place not only within the district but outside as well. Notably, just outside of the district, the 5 stories, 244-bedroom unit that is 401 Oberlin Apartments was bought by TA Realty for a whopping $91.2 Million!

Despite the past couple of years of initial economic downturn with no understanding of how long it will last, the community has reached a point in the pandemic where people can project the economy getting better; therefore are investing. Overall, there is a lot of trust that the economy and business are going in the right direction.